Dear Creators, we are proud to announce an amazing affiliate program for you to earn some serious and continual cash. Read about our affiliate progarm here.

Caros criadores, temos o orgulho de anunciar um incrível programa de afiliados para vocês ganharem muito dinheiro de forma contínua. Leia sobre nosso programa de afiliados aqui.

Retire Fast Without Females - MGTOW

Sponsor Link:

- MGTOW's Guide to Retiring on $200K in SE Asia

- http://www.mgtowbooks.com

- Promo code SANDMAN for 10% off

Sponsor Link 2:

- THE-DOLL-HOUSE SAN ANTONIO LLC

- http://www.sanantonio.the-doll-house.com

Sponsor 2 YouTube Link:

- THE-DOLL-HOUSE SAN ANTONIO LLC

- https://www.youtube.com/channe....l/UCfniYT9wJHMlonj6d

MGTOW Mystery Link: https://www.msn.com/en-ca/news/canada/ottawa-businessman-tells-incredulous-judge-he-burned-dollar1m-cash-to-keep-it-from-ex-wife/ar-BBZDxu3?li=AAggNb9&ocid=mailsignout

SubscribeStar.com: https://www.subscribestar.com/sandman

Brave Browser: https://brave.com/san644

Hi Everyone Sandman Here,

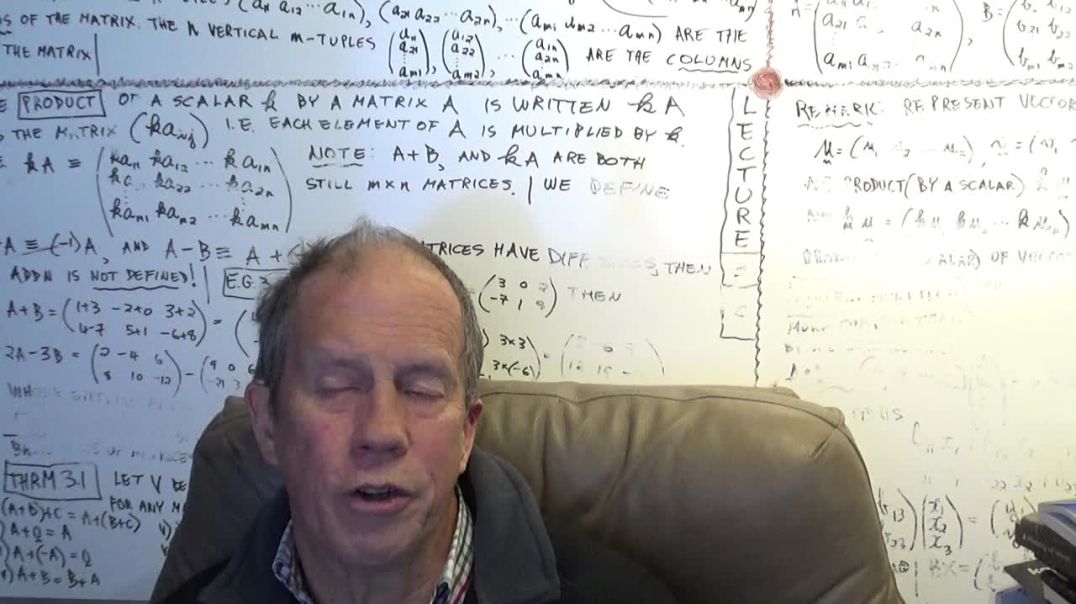

This video is brought to you by a donation from Luca Vendetti the Author of a the MGTOWs guide to retiring on 200k in Southeast Asia. He wants me to spend this video discussing different retirement strategies that include his with regards to becoming an ex pat and moving to Southeast Asia and relying on the cheaper cost of living and higher interest rates from the governments in Asia to make your capital generate a higher rate of return. Before I discuss the Ex Pat strategy of moving somewhere cheaper to live as other strategies like the early retirement strategies I'm following including a dividend growth strategy as well as how to speculate more successfully let me first tell everyone about Luca's book I just mentioned The MGTOW's Guide to Retiring on 200K in Southeast Asia: Anyways, now back with the show. The first retirement strategy I want to discuss is the Dividend Growth one. This involves dollar cost averaging into blue chip dividend stocks in places like Canada and the US. Stocks like AT&T, Johnson & Johnson or Pepsi. Companies that pay somewhere between three to six percent a year yield and increase their dividends on a consistant basis. If for example I took a million bucks and invested it in Dividend paying stocks that yield on average of five percent that would give me fifty thousand dollars a year and it would be the equivalent of around sixty-five to seventy thousand dollars a year in before tax income because the dividends are taxed at your marginal tax rate. If you don't have any other forms of income then you virtually pay no tax and have a middle class lifestyle. Of course the issue is about getting to one million dollars or in the case of Luca's strategy getting to two hundred thousand dollars. If you're not in a relationship or have a family you can start saving in your late teens and early twenties in a hurry. If you live with room mates and take public transit or live within walking's distance to your job the savings start to pile up. If you start this strategy in your early twenties then you will have a million bucks in dividend paying stocks by the the time you reach your mid to late forties. But of course the problem is inflation. While you can certainly live off of fifty thousand a year today as a single man. It's going to be difficult if not impossible to do so in another twenty to twenty-five years. The problem is that many financial advisers show you such a huge sum of savings but they don't really discuss inflation because they are after all trying to sell you financial investments and it's in their interest that you don't know the full facts. Besides by the time you learn it's not enough to retire 25 years will have past and you won't be able to find that adviser because he'll be dead or retired himself. So while a dividend strategy is great it has to be incorporated with other strategies. Plus the only thing that can de-rail a portfolio like that is something like the Novel Corona Virus. In the last couple of years I've done well with this strategy and on February 5th I sold more about sixty percent of my dividend paying stocks for a fat profit. I did that not because they were a bad investment but because based on the trajectory I see on this analytics dashboard that I captured this image.

10 images licensed and paid for through BigStock.com. All image licenses are available upon request.

Video Background Credits:

Particle Wave 4K Motion Background by "Videezy.com"

SORT BY-

Top Comments

-

Latest comments

5 years ago

Retire with shit load of money without them .

5 years ago

dividend stocks wont make it for you. As a kid min wage was 2.75 an hr .... 50 yrs later min wage is 15.00 hr.......... INFLATION. I believe that the USA WILL financially IMPLODE in the next 20 yrs....... hard assets guns gold , they have prevailed for 1000's of years after man screws.

INVESTING IN THE MARKET IS GAMBLING ... BitCoin DOESNT PHYSICALLY EXIST YET gamblers are paying 8000.00 bucks for 1 non existent bet on a game of musical chairs........... until the financial and govt collapse, guns and gold...........

5 years ago

5 years ago

Sandman see, https://www.myownadvisor.ca/dividends/

Subscribe and you get a pretty good spreadsheet summarizing about 100 Dividend stocks (Canadian focused) every month...... thank me later.

5 years ago

Retirement is just earning enough passive income to cover your essentials.